This account allows customers to earn interest on their checking balances over $500. The account owners can order cashier's checks from the bank without any additional fees. Since the typical fee is up to $10, those using cashier's checks often can save significantly.

If you prefer personal checks, you'll also get a $10 discount. Current Terms and Rates 0.01% APY Having a Way2Save® savings account makes saving an easier and more automatic part of your financial habits. You have to link the account to a Wells Fargo checking account to take advantage of two automatic savings options. Your first option is to use the Save As You Go® transfer program.

This allows the bank to automatically transfer $1 from your checking account every time you make a debit card purchase, pay bills online with Online® Bill Pay or make automatic payments from your checking account. Your other option is to set up monthly or daily automatic transfers in amounts of your choice. If you're saving monthly, the deposit has to be at least $25, with the daily minimum set at $1. Get $400 when you open a new eligible Wells Fargo checking account with a minimum opening deposit of $25.

Within 150 days of account opening, you must have a total of at least $3,000 each month in qualifying direct deposits for three consecutive months. Get $250 when you open a new eligible Wells Fargo savings account in branch with a minimum opening deposit of $25. Deposit at least $15,000 in new money within 10 days of account opening.

Maintain a minimum daily balance of at least $15,000 for 90 days from account opening. Bonus will be deposited to your new accounts within 45 days after meeting all offer requirements. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account.

For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement.

Nevertheless, Wells Fargo tries to make up for it with other features you don't often see in brick-and-mortar savings accounts. For example, this account includes a debit card for direct access to cash. It also offers automatic savings tools, like Save As You Go® transfers.

Еhe premium service for eligible customers offers bonus interest rates as well as zero-commission at external ATMs . The account owners get interest on their account balance, earn rewards, receive loan discounts, and are served by the Premier support team. No fees incurred for Wells Fargo Personal Wallet checks, cashier's checks, and money orders. The monthly $30 fee is waived for those having $25,000 or more in qualifying linked bank deposits, or over $50,000 in qualifying linked bank, brokerage, and credit balances. Premium clients also get an annual Relationship bonus on the non-bonus rewards points they earn with the Wells Fargo Propel World American Express Card.

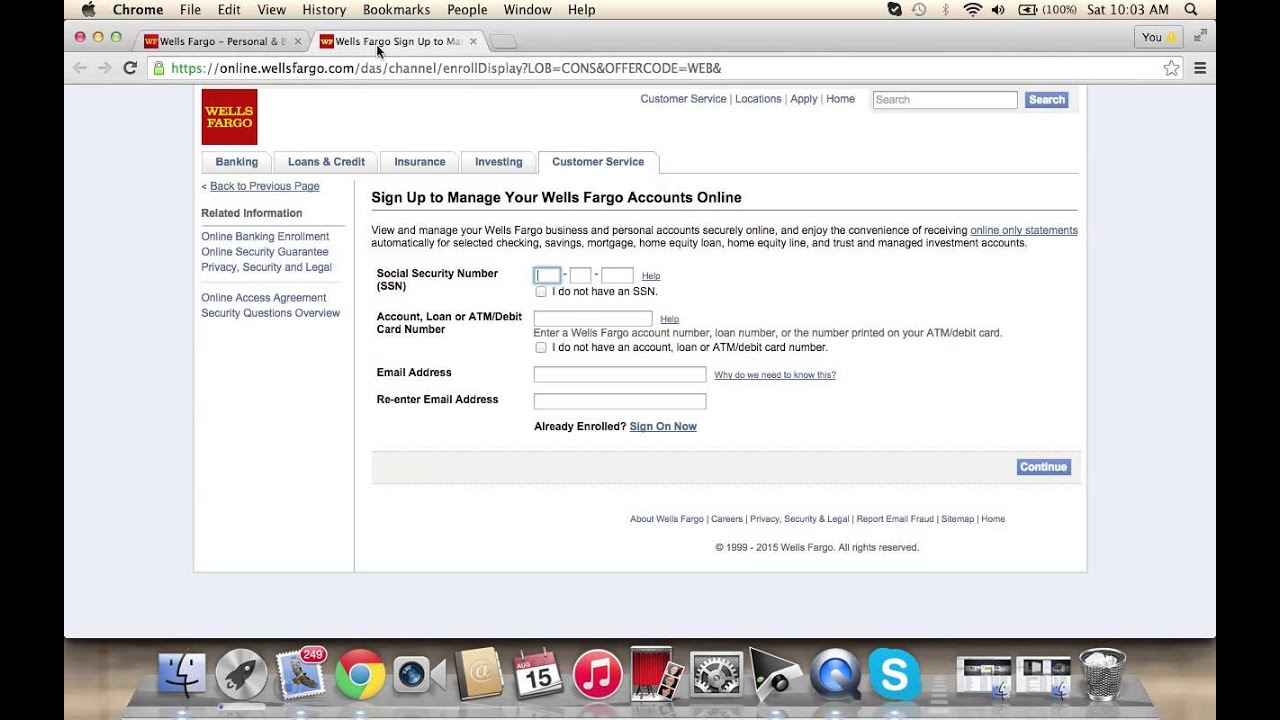

To open a checking account online, you'll have to indicate a zip code for the US city of your residence. That is necessary to show you appropriate offers and prices. You also have the opportunity to open both an individual and joint bank account, so you have to choose a suitable variant. With a joint account, you and your partner can pay shared household expenses, such as a mortgage, car payments, utilities, and groceries, from the same place.

Moreover, joint account funding may help you meet the minimum balance requirements that qualify you for features like waived maintenance fees, a higher interest rate, or additional rewards. The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period.

Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. 1 Enrollment with Zelle®through Wells Fargo Online®or Wells Fargo Business Online®is required. For your protection, Zelle®should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle®is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. Neither Wells Fargo nor Zelle®offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle®through their financial institution.

Small businesses are not able to enroll in the Zelle®app, and cannot receive payments from consumers enrolled in the Zelle®app. For more information, view theZelle®Transfer Service Addendum to the Wells Fargo Online Access Agreement. Other software companies realized that there was potential to become the platform of choice for customers to do their banking.

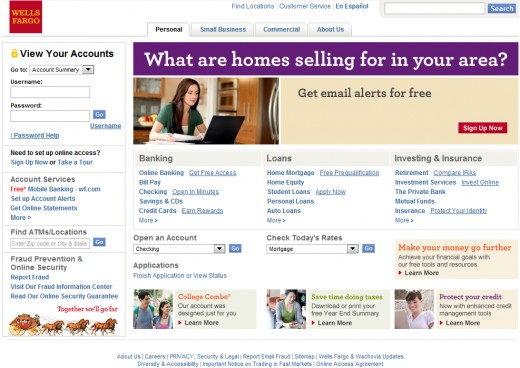

Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information.

Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service. Key Features Details Minimum Deposit $25 Access to Your Checking Account Online, mobile, over the phone and at physical branches. Security FDIC insurance up to the maximum amount allowed by law. Fees $3 monthly fee, waivable with online-only statements This Teen Checking account is available to teens from 13 to 17 years old. The account will need to have an adult co-owner, although both parties will have equal access to the account.

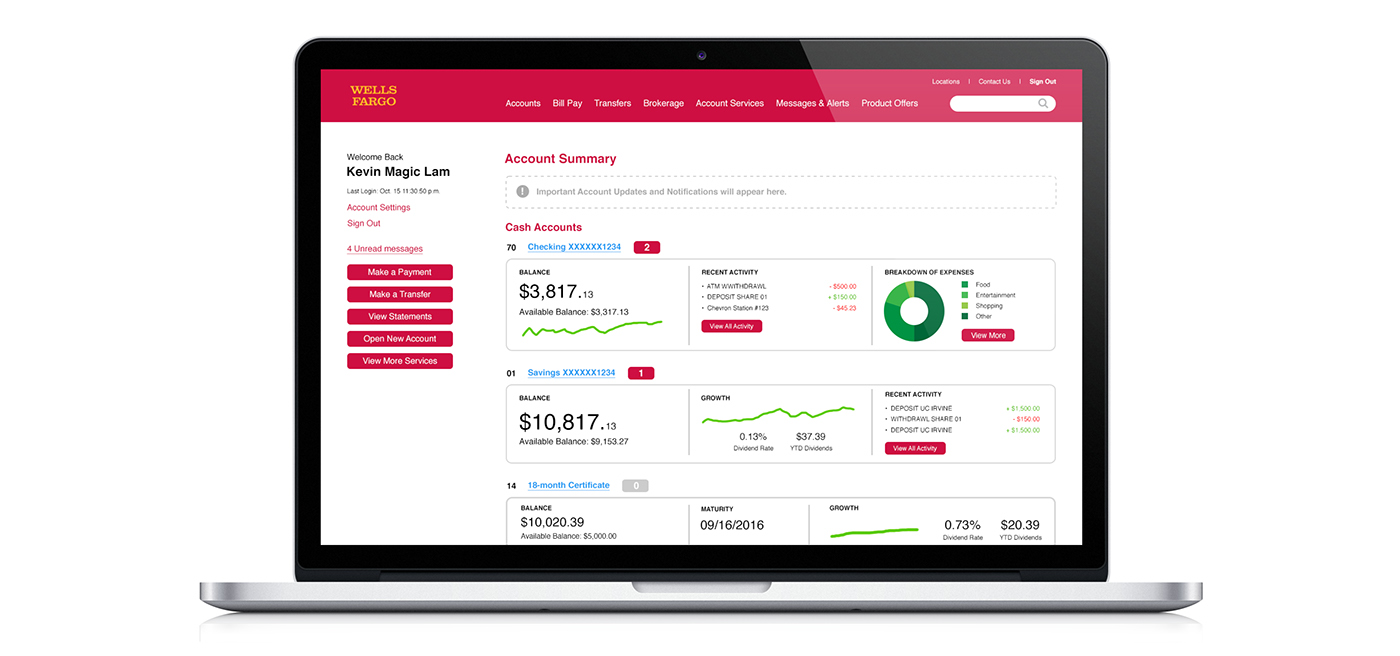

Plus, monitoring the account is made easy for both parents and teens with account alerts, online access and mobile banking. Parents can set limits on purchases and withdrawals to help their children learn about responsible spending. Account holders will also have access to My Spending Report with Budget Watch which works to help customers develop budgeting skills with free money management tools. All of the Wells Fargo business checking accounts provide access to online and banking tools, which include mobile check deposit, online bill pay, text banking and digital wallet capabilities. These tools allow you to customize account and user access, set up alerts and even turn your cards on and off.

Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day. The fee can be avoided if a covering transfer or deposit is made on the same business day. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24.

Open an Everyday Checking account online or bring a bonus offer code to a participating Wells Fargo branch and open an eligible consumer checking account. Gives customers unlimited branch and ATM withdrawals and the option to write checks. Optional overdraft protection for your checking account is another benefit. The account is better suited to those having higher savings goals.

Thus, the monthly service fee of $12 is waived when you maintain a $3,500 minimum daily balance each fee period. The most popular Wells Fargo checking account has custom text and email alerts to monitor account activities. It's supplemented by a Platinum debit card with chip technology.

Unlike Clear Access Banking, this account has a check-writing option. It also brings additional benefits to students if Wells Fargo Campus ATM or Campus Debit Card is linked. The fee is waived if the owner has a $500 minimum daily balance or $500 and more in total qualifying direct deposits. You can also enjoy a zero service fee if you are 17 through 24 years old or have a linked Wells Fargo Campus Card.

The account's perks extend beyond the account itself, too. Wells Fargo recently updated its fee schedule checking accounts, making it harder for some people to avoid a monthly $10 service fee. Accountholders will be charged a monthly fee if they don't meet certain criteria, including items like maintaining at least a $500 daily balance or $500 in monthly direct deposits. Meeting any one of these items, among others, will result in a fee waiver. But 10 or more monthly debit card transactions will no longer count as a fee waiver option after October 8th, 2020.

Open an eligible consumer checking account online or bring a bonus offer code to a participating Wells Fargo branch. Within 90 days of account opening, receive a total of $4,000 or more in qualifying direct deposits to your new checking account. After the initial 90 days of account opening, your bonus will be paid within the next 30 days if you have met all offer requirements.

A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices . Customers can use a debit card with contactless and chip technology instead, pay bills online, and make digital payments. Mobile deposit is only available through the Wells Fargo Mobile app. $5 monthly service fee is waived for primary account owners 13 to 24 years old, although teens 13 to 16 need an adult co-owner.

Since these accounts are offered to consumers who have been denied a bank account, do your research beforehand. Some may come with restrictions like higher monthly fees and/or minimum balance requirements. The good news, however, is that they allow to to rebuild your banking history over time so that you can later qualify for a standard checking or savings account. This checking account is for customers with substantially higher account balances. While a high balance isn't required to keep your account, it allows you to earn at a higher interest rate and have the account's high monthly fee waived.

Account balances of $250,000 or more also waive fees for incoming wires, stop payments and ExpressSend remittance services, and receive unlimited reimbursement for non-Wells Fargo U.S. ATMs . Many banks also offer optional overdraft protection services. With overdraft protection, you can link your checking account to another account, such as a savings account, so that overdrafts incurred on your checking account are covered by the available funds in the linked account.

You may be charged a fee for the overdraft protection transfer, but it is usually lower than the bank's standard overdraft fee. Opening both at the same bank and linking them could give you the convenience of easily transferring money between accounts,2 and some banks may even offer some perks for opening both a savings and a checking account. Also check to see which account may have a special benefit for students, such as waiving the monthly service fee, which Wells Fargo and many banks offer. There could be many reasons why you want to close your bank account. It's not uncommon for traditional banks to offer free checking accounts only for you to be slammed with hidden fees later on.

Or for banks to promise high yields on investments and savings accounts, but then you realize the high fees that come with the high yield don't really make it worth it. On the other hand, some banks just make it outright difficult for immigrants. Now you've found a better banking solution and want to get rid of the hassle.

OnJuno's FDIC insured High Yield Checking Account can help you earn an industry-leading 1.20% on all deposits. No more anxiety of switching between checking and savings accounts. Wells Fargo offers to check and savings account options to both resident and non-resident foreigners. The accounts can usually be linked to a debit card or an ATM card – giving you quick access to cash – and can be managed online, as well as at ATMs. However, those who reside within the US have the advantage of opening their accounts online, which is a great benefit while pandemic health concerns still occur.

Non-residents would have to visit one of the bank's numerous branches in person. Wells Fargo provides a pretty well-rounded banking experience for its customers. You have a wide variety of bank accounts to choose from, alongside credit cards, auto loans and more.

So whether you want a simple savings account, a Special CD or a checking account for your teenage daughter, you can find that here. These types of monthly fees are not uncommon, but there are both brick-and-mortar and online competitors that can offer fee-free account options. Wells Fargo is a bizarre combination of hits and misses. This bank offers some rare benefits, like a debit card for your savings account and discounts on loans to customers with multiple accounts. But it falls short in other key areas, like CD terms and customer satisfaction ratings. It's also not going to impress anyone interested in high rates.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.